Wind Industry Background Check:

Wind Industry Background Check:

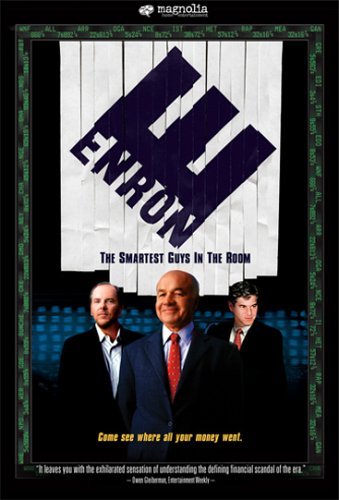

The current 'Wind Industry' as it stands would not exist without Enron. This short summary from the University of Iowa explains the connection:

SOURCE: University of Iowa, Center for Agricultural Taxation

"Wind Energy Production: Legal Issues and Related Liability Concerns for Landowners in Iowa and Across the Nation"

Click here to download entire document.

OVERVIEW:

Farmers have long used wind energy. Beginning in the 1800’s, farmers installed several million windmills across the Midwest and Plains to pump water and generate power for lights and radios.

Today, farmers, ranchers, and other rural landowners in suitable areas are utilizing wind energy in a different manner.

But, where did the current emphasis on wind generation of electricity come from?

There were early attempts dating back to the 1970s and 1980s, but it wasn’t until the late 1980s and early 1990s, that Enron (an energy company based in Houston, TX) lobbied the Congress with a friendly “renewable energy” project, and packaged it with their “electricity deregulation” lobbying and political efforts.

Their efforts were successful in getting laws passed at both the federal and state levels that would permit them to tie into the grid, require utilities to buy unreliable and unpredictable electricity (i.e., electricity generated by wind) under Renewable Portfolio Standards, allow them to sell “renewable energy certificates” separate and apart from the electricity, and utilize a newly created production tax credit and take advantage of a special accelerated depreciation rule.

SECOND FEATURE:

More from the University of Iowa report: Property Values

"At the present time, anecdotal data indicates that wind turbines have a depressing effect on nearby land values and are a drag on the ag real estate market.

Most recent anecdotal data from Illinois indicates that assessed value on farmland is dropping approximately 22-30 percent on farmland that is near land where wind turbines

have been placed.Also, the increased risk of getting sued for nuisance has a dampening effect on value. Likewise, the annual payments, to an extent, are replacement income for the property rights that have been given up in getting the turbines in the first place.

Many of the agreements are quite restrictive in terms of potential development of the property, farming activities, placement of buildings, etc.

A willing buyer would take all of those factors into consideration when determining what price to pay for the property "

- "Wind Energy Production: Legal Issues and Related Liability Concerns for Landowners in Iowa and Across the Nation"

University of Iowa, Center for Agricultural Taxation

THIRD FEATURE:

Note from the BPWI research nerd: In an already depressed housing market, those who live in areas where wind farms have been proposed have a new problem to contend with when trying to sell their homes. Will the disclosure about the coming wind farm help or hurt the sale? What happens if you sell your home without disclosing it?

More from the University of Iowa report: Contractual Issues

In a recent New York case, the plaintiff bought the defendant’s farm (including the residence) and sought to have the sale contract rescinded based on the seller’s alleged fraud and misrepresentations for not disclosing that plans were in the works for the construction of large wind turbines on an adjacent parcel.

The plaintiffs submitted the affidavit of a neighbor of the defendant who detailed two conversations with the defendant that occurred months before the defendant put his farm on the market during which the wind farm development was discussed.

The defendant, at that time, stated that the presence of commercial wind turbines on the adjacent tract would “force” him to sell his farm.

When the plaintiff sought to rescind the contract, the defendant claimed he had no duty to the plaintiff and that the doctrine of caveat emptor (“buyer beware”) was a complete defense to the action.

The court denied summary judgment for the seller and allowed the case to go to trial.